A Better Way to foster

Economic Diversity in Housing

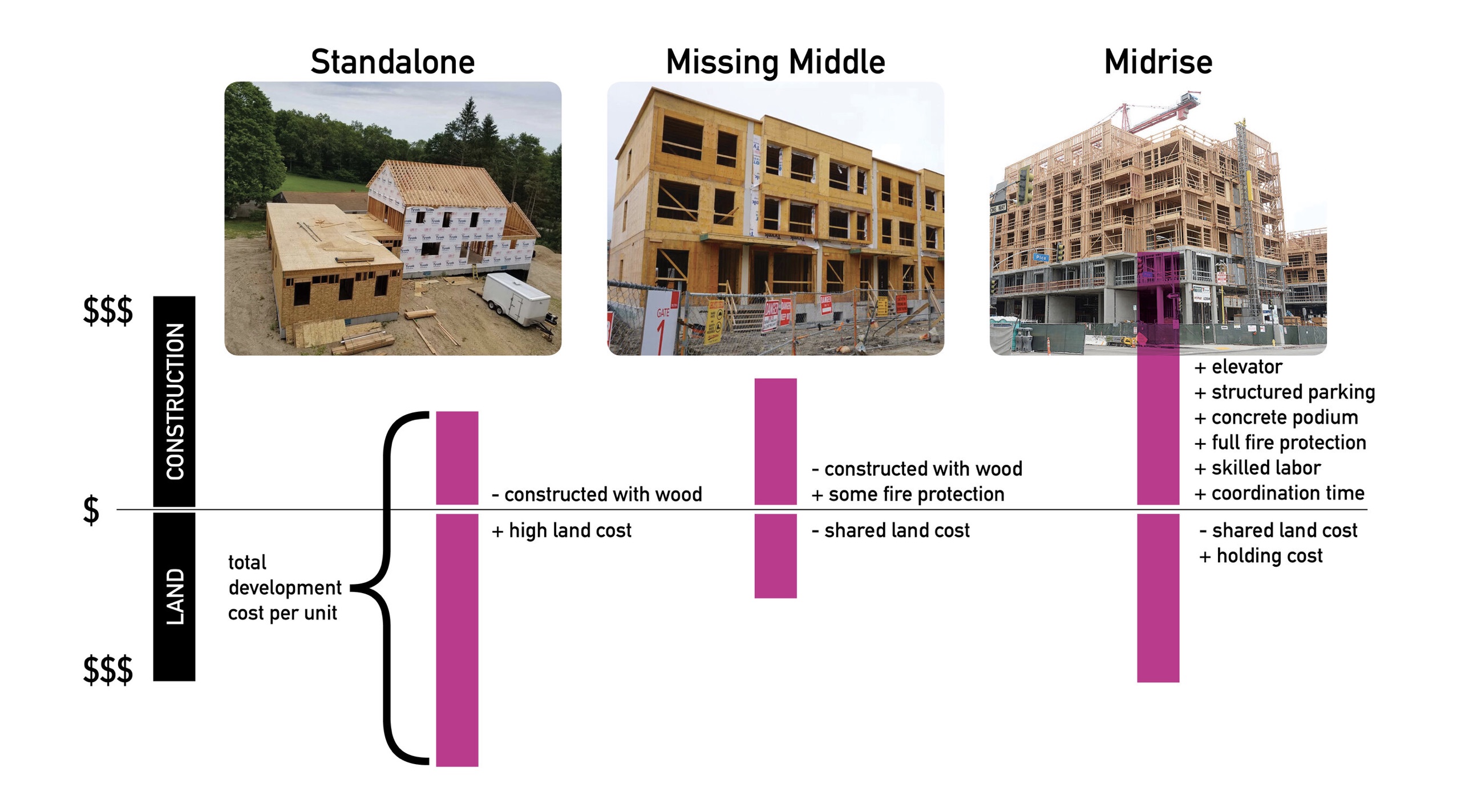

“Missing” Middle is low-rise stick built housing and is affordable by design.

Strengthen and add to the economic diversity of housing options Summit Hill

- WE HAVE— a rich mix of Middle-Density housing types with a wide variety of housing costs — including below-median rate apartments and condos. The average rent in Summit Hill for a 1 BR unit is affordable at 50% of AMI.

- THE DEVELOPER PROPOSAL — is luxury housing that will put gentrification development pressure on all of east Grand and lead to the loss of existing NOAH (Naturally Occurring Affordable Housing).

- A BETTER WAY— We don’t need more luxury housing in Summit Hill. We need more median housing and more affordable housing. Summit Hill has diversity in the housing options and we want to build on that by mandating that new housing provide housing at 50% at AMI rate. This matches the current average rent in Summit Hill (Source: MHP (full report)). We want to preserve NOAH (Naturally Occurring Affordable Housing) by staying at a supportive scale. A smaller project with less costly features would be more affordable for new neighbors.

Unaffordable Housing

According to the developers at various public meetings, the rent for these new apartments will start at $1400 for the smallest units – “alcove” (studio) apartments of around 550 SF each. Each unit will have its own PTAC heating unit, so residents will pay their heating and cooling on top of their rent. Parking, for those with cars, will cost an additional $175 per month. One bedrooms will rent at $1850 and two-bedroom units $2750. The rent in these apartments will be double the going-rate in Summit Hill.

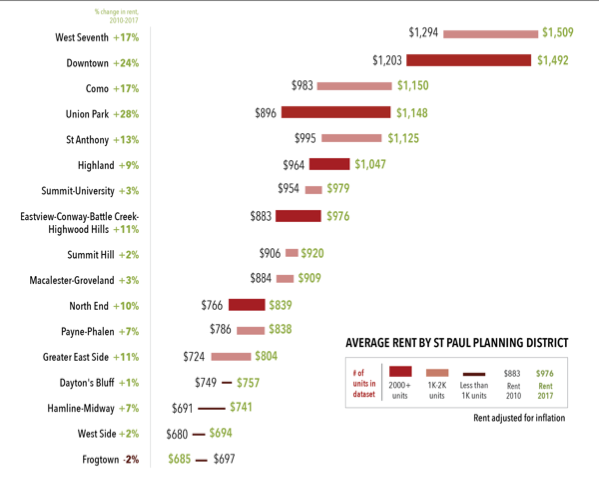

Minnesota Housing Partnership (MHP)’s 2016 report “Sold Out” : Summit Hill has an average rent range from $906 to $920. The current average rent would be considered affordable for a 2-BR unit for a household with income at 50% AMI or a 1-BR unit at 80% AMI, according to affordability amounts from the Met Council (source). The rents in Summit Hill were also among the lowest increases, with an increase of only 2% between 2010-2017.

Minnesota Housing Partnership (MHP)’ s report “Sold Out” provides average rents for the City of St Paul by planning district; Summit Hill has an average rent range that increased from $906 to $920, which placed it squarely in the middle of the 17 planning districts: ninth from the highest and ninth from the lowest average rent (Source: MHP (full report)). In comparison with bordering districts, Summit Hill’s #9 rank average rent was lower than West Seventh (#1 highest average rent), Downtown (#2), Union Park (#4), and Summit-University (#7) , and just one rank above Macalester-Groveland (#10). This average rent would be considered affordable for a 2-BR unit for a household with income at 50% AMI or a 1-BR unit at 80% AMI, according to affordability amounts from the Met Council (source). The rents in Summit Hill were also among the lowest increases, with an increase of only 2% between 2010-2017.

s report “Sold Out” provides average rents for the City of St Paul by planning district; Summit Hill has an average rent range that increased from $906 to $920, which placed it squarely in the middle of the 17 planning districts: ninth from the highest and ninth from the lowest average rent (Source: MHP (full report)). In comparison with bordering districts, Summit Hill’s #9 rank average rent was lower than West Seventh (#1 highest average rent), Downtown (#2), Union Park (#4), and Summit-University (#7) , and just one rank above Macalester-Groveland (#10). This average rent would be considered affordable for a 2-BR unit for a household with income at 50% AMI or a 1-BR unit at 80% AMI, according to affordability amounts from the Met Council (source). The rents in Summit Hill were also among the lowest increases, with an increase of only 2% between 2010-2017.

“Unaffordable Housing is kind of a big deal. What’s causing it? If you ask most developers, it’s that we don’t have enough housing supply. The developer lobby asks government to remove development restrictions and regulations so they can supply the market with more units. As I pass the condo towers in my city in the evening, it’s hard to see unit supply being the problem. There are very few lights on… The condo towers have gone dark. There are no lights on because there’s nobody home. Are we building homes or are we dressing up a paper asset?” –Justin VannPashak

Luxury Housing Causes Displacement

Shelterforce report shatters the flawed argument that building anything will trickle down to affordable housing. On the contrary, new construction of luxury housing has been shown to fuel the displacement of lower income housing, and that affect is amplified in neighborhoods where lower housing cost areas border higher housing cost areas. Summit Hill has a significant number of above-area-median priced housing options, mostly in the form of single family homes. The NOAH rental and condominium options have historically balanced these high income options, resulting in a wider range of household income levels in the neighborhood. By introducing luxury rental housing to Summit Hill, this proposal will tip the balance toward fully gentrifying Summit Hill.

Market-rate housing production causes significant price impacts in surrounding neighborhoods, raising area rents and real estate taxes (Oliva 2006; Pearsall 2010; Zuk and Chapple 2016). These price impacts have resulted in higher housing cost burdens for low-income residents, as well as their displacement (Davidson and Lees 2005, 2010; Pearsall 2010). –Shelterforce

Another Shelterforce article digs into the complicated economics of housing, noting in particular that “Economics 101” of supply and demand do not apply in housing. Housing is a segmented market, in terms of whose demand can be met by what market segment of supply. Additionally, there are myriad factors besides the simple supply principle that factor into where people can live. Further, increasing supply at the luxury and high cost end of the spectrum causes “most of the benefits flow to the rich.”

Cities, however, can use their considerable sway over developers to incentivize building middle range housing, whose benefits are more likely to filter to affordable and very low costs housing. This is benefit is important since it is the middle market housing can be constructed by private developers, while affordable and very low costs housing can only be constructed with subsidies. Moreover, municipalities can also use their considerable sway over developers to incentivize the inclusion of affordable units within a portion of a project. Unfortunately, in this project the developer is asking the City to relax those rules for luxury housing, and not in exchange for including affordable units or even providing middle market units. Why would the City even contemplate trading relaxed rules for a project whose benefits will go mostly the rich?

Local planning and zoning regulations have enormous impact on what and where it is financially feasible to build. Time and again, urban voters have shown a willingness to trade relaxed density rules or reduced parking requirements in exchange for more affordable housing units.

Contrary to claims of NIMBYism, Harvard researcher Michael Hankenson has found that neighbors support affordable housing even more when it is in their backyards: “People supported affordable housing more strongly the closer it was to their home. And, surprisingly, this difference was exactly the same for projects that were 100 percent affordable and those with only 25 percent affordable housing.”

Missing Middle = more affordable Housing

About a decade ago, Opticos coined the term “Missing Middle — this is a type of housing that provides density at a compatible scale to houses. And Middle Housing is NOT missing in Summit Hill. We have lots of it — mostly build before 1940. We want more. We don’t want oversize suburban boxes that belong elsewhere. Here are the advantages of Missing Middle, courtesy Opticos.

- Missing Middle – What is it?

What? Missing Middle Housing www.missingmiddlehousing.com

- House-scale buildings with multiple units in walkable neighborhoods

- A range of house-scale buildings with multiple units—compatible in scale and form with detached single-family homes—located in a walkable neighborhood.

Why?

Smaller homes and apartments cost less to rent or purchase and maintain, while urban neighborhoods provide services and amenities within walking distance as well as a variety of affordable transportation options. Optional amenities like club rooms and workout spaces add expense and building bulk, all to attract luxury renters. Who needs a gym space within the development when there’s neighborhood amenities like CorePower yoga and walking/jogging/biking along beautiful park-like Summit Avenue? Leaving these items out will make housing more affordable and more at scale and support

walkability because residents will access these services in the neighborhood.

Building smaller buildings lowers the expenses of constructing and maintenance. Bigger, more complex buildings require expensive things like multiple elevators. Screened and well designed surface parking at the rear for the retail and restaurants would save money and be more accessible to customers. Having main floor ADA-accessible units along St Albans would reinforce the residential character of St Albans, and lessen the need for costly elevators. The project could ahve just one elevator or even no elevator, lowering building costs and increasing affordability while still complying with accessibility requirements and goals. According to WC Studio Architects, a firm in Tacoma Washington, “we believe the Missing Middle represents a sweet spot for neighborhood scale development with great affordability potential.”

The current multi-family building boom of “five-over-ones” is a Wall Street driven trend to create Real Estate Investment Trusts (REITs). These investment-fun-owned properties are an increasing problem for comerical property along Grand Avenue. Are they coming for our rental housing as well? The Ohio Teacher’s Unions owns several properties on Grand Avenue, including Victoria Crossings. The fund-owned properties have been marred by high rents and high vacancies, and rent almost exclusively to national chains:

“These buildings wouldn’t be going up if no one wanted to move in, of course. Growing demand, brought on bydemographicshifts, job-growth patterns, and a renewed taste among affluent Americans for city (or citylike) living, has shaped the mid-rise boom. So have the whims of capital. Most multifamily developers build to sell—to a real estate investment trust, an insurance company, a pension fund, or some other institutional investor. These owners aren’t interested in small projects, and their bottom-line focus determines not only materials but also appearance and layout. –Bloomberg

There is a shortage of affordable housing in the Twin Cities, from median-priced housing and down, with a severe shortage of housing for those households with incomes at 30% and lower of AMI (Area Median Income). Meanwhile, recent large projects of luxury housing are marred byhigh vacancy rates.

There is no evidence that St Paul needs more market-rate units, particularly given the large number of vacant units still available in nearby properties such as “The Grove,” “The Harper,” and the soon to open “Pivot” and other properties. While affordable (under $300,000) homes are being torn down weekly in the city to be replaced with larger, far more expensive homes (ironically also needing variances), these new construction apartments struggle for occupancy, with vacancy rates at or near 50%. Tellingly and forebodingly, developers admit at community meetings that these are, at best, “medium term” investments slated to be sold to a REIT within 5-7 years.

“Though there’s still a dire shortage of apartments that are affordable to low-income renters across the metro, owners of market-rate and luxury buildings are negotiating increasingly complex circumstances, especially in Minneapolis and St. Paul where the COVID-19 pandemic and rising crime has stifled demand in the urban core where there’s still a robust development pipeline of new properties.”

― Star Tribune, Nov 12, 2020

Where do people want to live? What type of housing? Ask the community. Summit Hill Association recently polled the neighborhood and found that 49.40% supported the East Grand Avenue Overlay district, which among other provisions limits building footprint and heights to “Missing” Middle scale. Only 13.86% wanted the overlay removed. A full 77.51% recognized that it was “valuable way” to maintain neighborhood scale, with 28.11% of those thinking it was valuable but could use “some change.” From Opticos, “However, many people prefer neighborhood living rather than city living, and five-plus-story buildings are too large for most neighborhoods. Missing Middle Housing is perfectly scaled to provide additional housing that fits in with the neighborhood character. Often, builders are finding it a great opportunity to respond to the demand for walkable neighborhood living with lower-price options than detached single-family homes and even townhouses.”

“When it comes to urban planning, we need to do a better job of listening to existing communities, engaging residents, and considering the long term impact of rezoning on the people who have lived in our neighborhoods most, if not all, of their lives. Once a developer’s shovel hits the ground, the die has been cast for generations. We have to do this right. – NYC Comptroller Scott Stringer, in a press release opposing Mayor DeBlasio’s affordable housing plan.

Why does historic preservation matter for affordability?

San Antonio Study:

Older buildings play an important role in housing affordability across the country. First, housing preservation is typically cheaper and faster than constructing new units and effectively combats blight. Older and historic neighborhoods offer a diverse housing stock at varying prices, sizes, and conditions, and are located in close proximity to transit and jobs. While older housing is more likely to be in poorer condition, the number of properties needing significant repairs is low—according to the 2017 American Housing Survey, only 2% of pre-1960 housing is severely inadequate and only 6% is moderately inadequate. A city cannot build itself out of a housing crisis—the retention of existing housing stock is critical.

3 premises:

- One cannot build new and rent or sell cheap without subsidy.

- Almost by definition, when a unit of older housing is razed, a unit of affordable housing is lost forever.

- Policies must include older housing stock (here defined pre-1960).

A key measurement of affordability is the concept of “cost-burdened.” A household is considered to be cost-burdened when it spends more than 30% of its income on rent and utilities and severely cost-burdened when it spends more than 50%. While an increase in value benefits homeowners by increasing their equity, it may burden those homeowners with higher tax bills. Further, increasing property values puts renters at risk as landlords may pass increased tax bills onto the tenants through increasing rents A recent study of new construction costs for Low Income Housing Tax Credit (LIHTC) projects across the U.S. found costs were approximately $40,000 to $71,000 (25 to 45 percent) higher per unit than those of acquisition-rehab projects.

We have so many good thing to say about historic preservation, we made it its own page.

aBetterWay-StP.com website 100% grass roots labor